Attention Auto Lenders: Use ROI to drive data investments and reduce charge-offs.

In our last blog we talked about John’s loan and the power of new vehicle location data insights in collections. We learned how using LPR data early in the collections cycle provides valuable insights to help prevent charge-off losses. Sounds great, right? But what does it cost – what is the cost per VIN, per click, etc.? Costs are important, but a singular focus on costs may cause you to miss the big picture. Data should not be viewed as a cost. Instead, data should be viewed as an investment to achieve better portfolio returns.

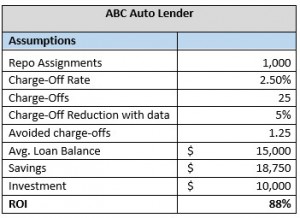

If someone offered you an investment opportunity that required a $10,000 investment and provided an $18,750 return AND you could expect that same ROI every month, you would jump at that opportunity. That same ROI is possible for auto collections and recovery. Yet, many lenders take a micro view and focus only on the cost of each repossession. With a macro view of your collections and recovery investments, it’s a no-brainer to invest in LPR data.

Here’s how it works:

The 88% ROI is not a made up number, it is a real return experienced by a real DRN customer from their investment in our vehicle location data. What returns are you missing out on? DRN can help!