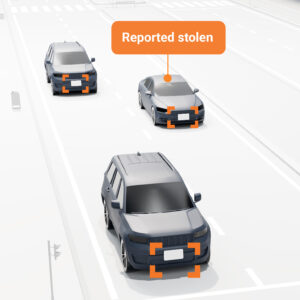

Rising Auto Insurance Fraud Costs: LPR Data Fights Back

This article is adapted from an earlier version published by Auriemma Roundtables. This DRN edition has been updated for our audience. The Growing Scope of the Challenge Auto insurance fraud remains one of the toughest problems confronting the U.S. insurance market. The Coalition Against Insurance Fraud estimates that fraudulent activity