As DRN’s License Plate Recognition (LPR) technology has advanced over the last several years, so has the need for lenders to access and use more data than ever before. DRN began introducing LPR into the repo industry in 2008 by launching what is known today as “Live Pick Up”. This is the process of placing a vehicle that is out for repossession into the DRN hotlist to leverage a scenario where a repo agent, who owns and operates DRN LPR cameras, can scan and recover vehicles in real-time. This process is managed by DRN’s nationwide network of forwarding partners, called “Live Pickup Providers”. Over the years, DRN has invested significant time and resources to make this product as beneficial as possible for lenders, forwarders and repossession agents.

After this LPR technology began to make an impact, lenders saw the power of the information being collected and wanted to gain access to this data earlier in the collection and repossession timeline. In 2015, DRN launched DRNsights, a web-based portal for lenders to access and leverage the Historical LPR data collected by the DRN camera kit network. Today, this database contains Billions of historical records and is collecting on average 220 Million new plate scans on a monthly basis.

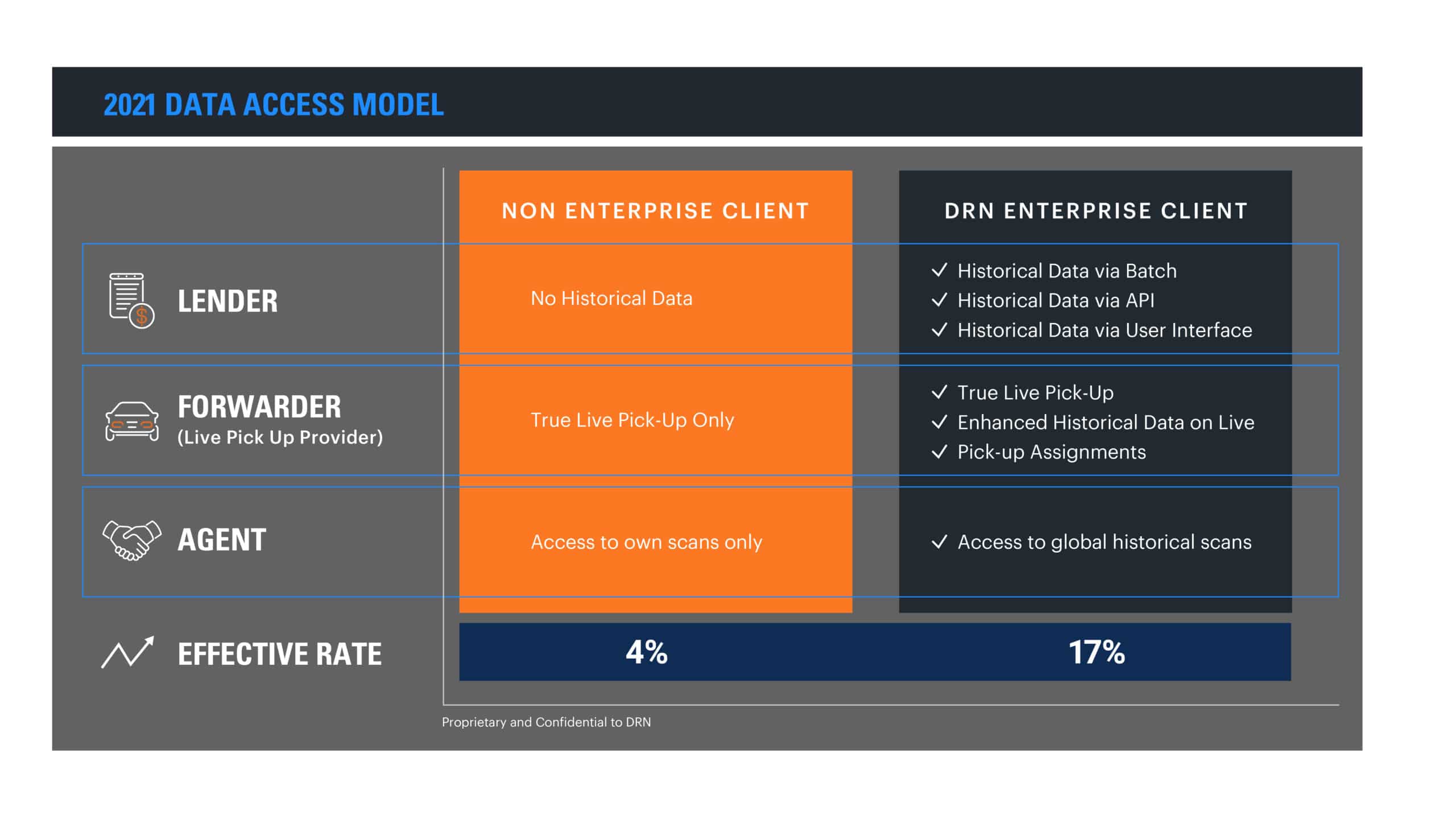

In 2020, DRN made enhancements to their Data Access Model to provide further value to clients that want to leverage the power of this historical scan data. In other words, a subscription to DRN historical data now empowers the lenders to feed the repo agents who are working to recover vehicles in the marketplace by using both Historical LPR Data and Real-time LPR Services.

To simplify this model, we created what is known as an Enterprise lender. This is an auto lender who wants to leverage the power of the historical data both internally and with vehicles that are placed with Live Pick Up Providers to leverage the Live Pickup Services.

As shown in the chart below, being an Enterprise Lender gives lenders the most access and coverage of LPR technology.

Through extensive analysis, we’ve seen that our Enterprise clients’ effective rate more than triples with access to Historical Data when compared to other clients who only use true Live Pick Up Services.

The bottom line? Accessing DRN’s Historical LPR data and the DRNsights Plus platform can be a game-changer, improving your recovery rates by upwards of 10-15%.. Lender clients typically see an ROI of three to four times their investment on LPR Historical Data alone. Beyond LPR data, lenders also are using DRN Products and Services at all stages of the loan life cycle, from portfolio monitoring (Risk Scoring, Active Duty Alerts), through collections (Skip Trace) and finally in the repo and charge off stages (Loss Alerts, Vehicle Search).

Are you ready to see how the full power of DRN’s LPR data and DRNsights analytics can help your business? Contact us on our website.